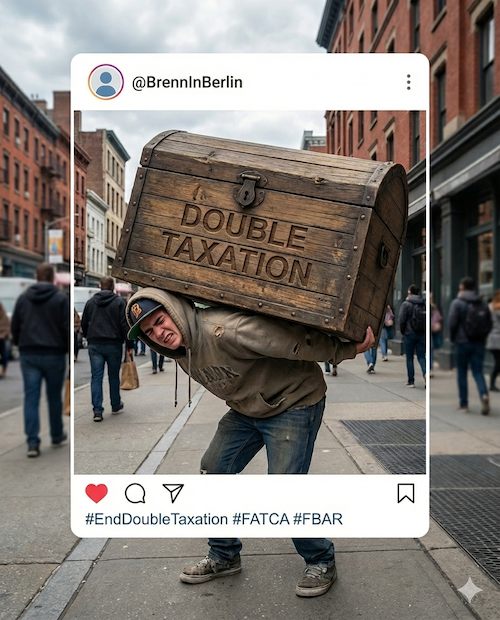

Double taxation and de-banking make a proud American begin to rue his U.S. citizenship

Double taxation and de-banking make a proud American living in France begin to rue his U.S. citizenship.

An American in Australia pleads for dignity, respect and freedom

A young American in Australia shares his experience trying to comply with a U.S. tax system designed to thwart hard-core tax evaders but which prevents normal people from leading normal lives.

Congress Can Fix Citizenship-Based Taxation

Why Rep. LaHood’s approach is particularly well-developed in evaluating the opportunity for residence-based taxation for Americans abroad and mitigating some of the transition risks.

From Michigan to London, a tax nightmare planning for retirement and children's education

Christina’s nightmare began as she and her husband tried to plan for their future—retirement, investment accounts and their children’s education.